Our Values

At NM Financial Services, we operate on a foundation of core values that guide our interactions and decisions:

- Client First Approach, i.e., prioritising clients' financial well-being over ours — always

- Personalised solutions tailored to their unique needs

- Acting with integrity and building trust through transparency

- Delivering advice backed by insight

- Staying current, staying relevant to help timely

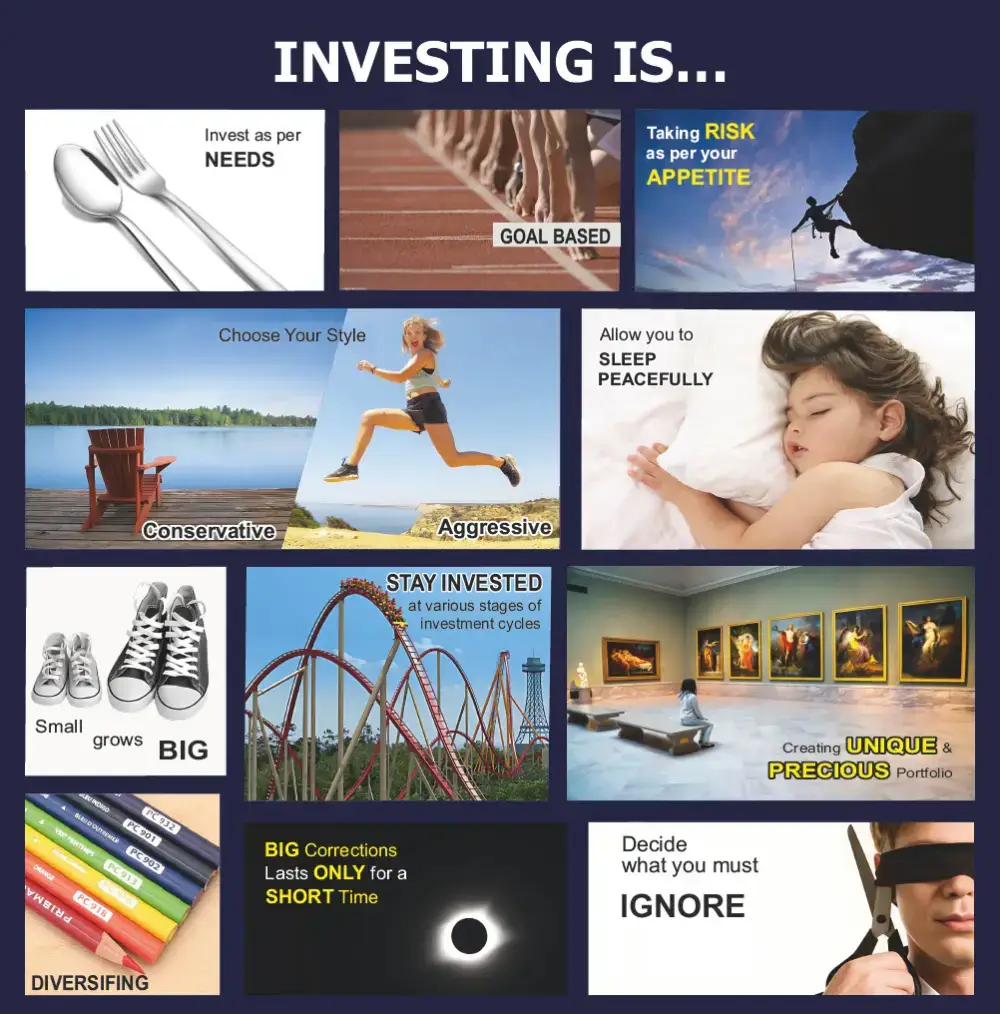

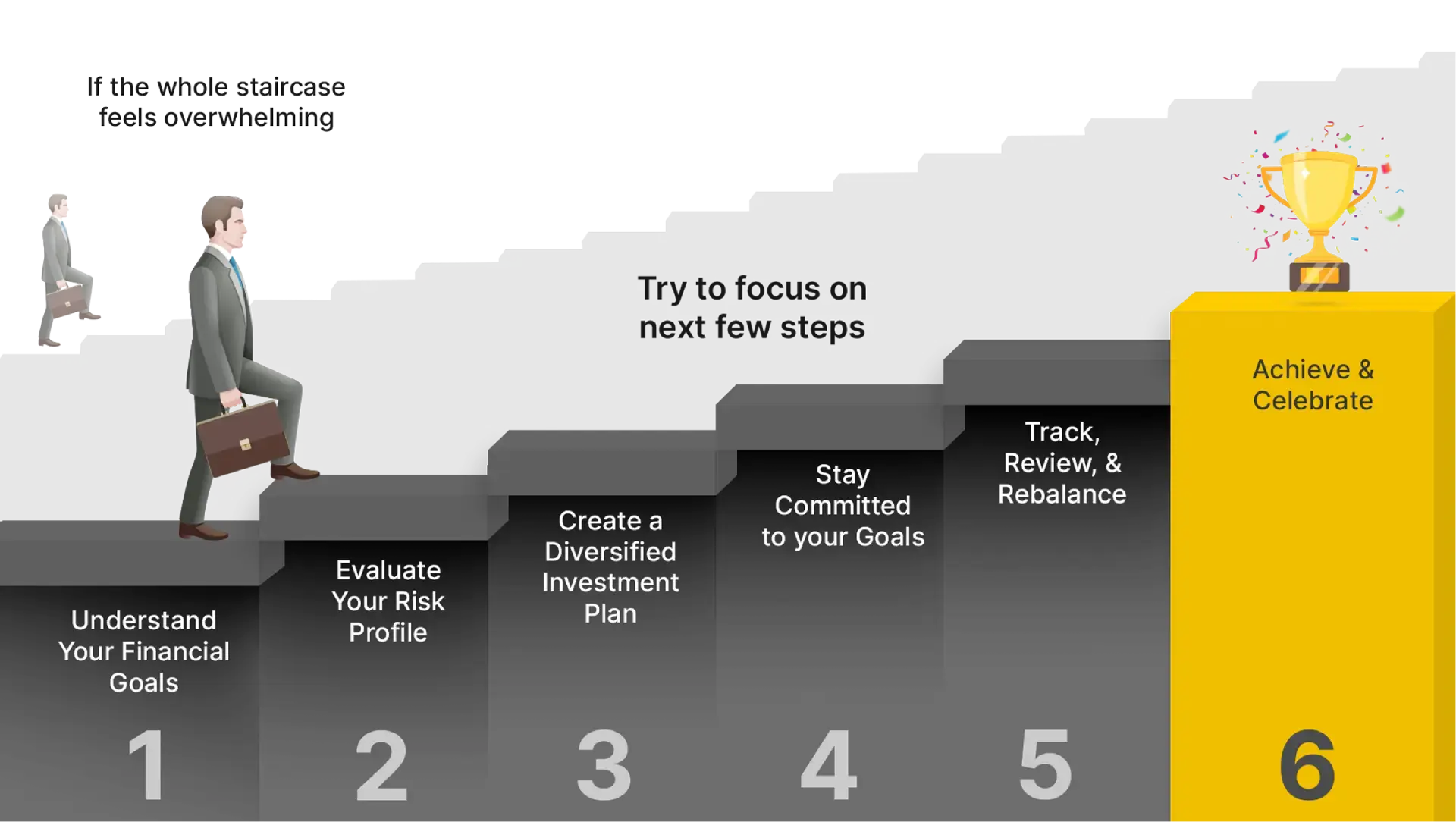

- Educating clients to empower their decisions and simplify investing

- Help clients achieve Financial Freedom

- Growing relationships, not just portfolios; Committed for the long run — together

Our Mission

To empower individuals to achieve their own definition of success.

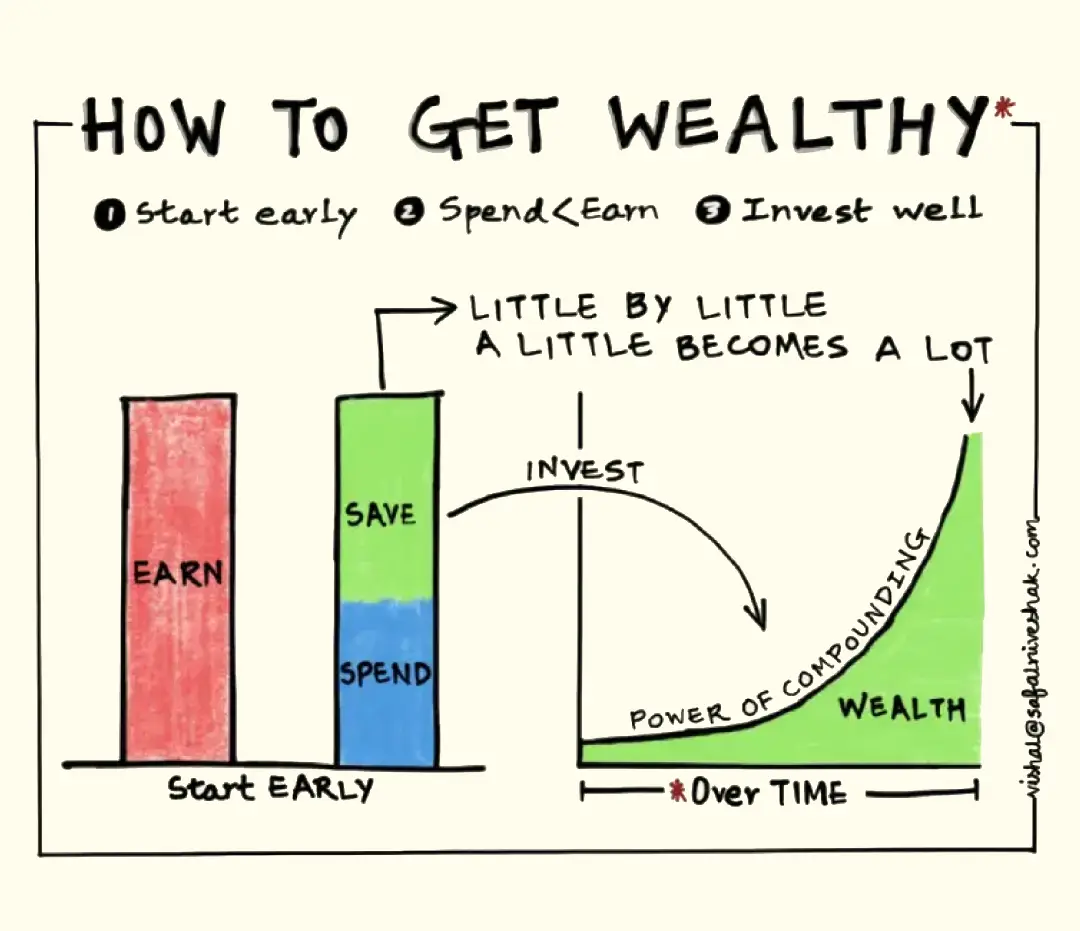

- We grow with our clients by guiding them on a journey of smart, long-term wealth creation — built on trust, knowledge, and clarity.

- At NM Financial Services, we turn hard work into lasting prosperity through the power of informed investing.

Our Vision

To build: “A Financially Aware and Empowered India”.

At NM Financial Services, we wish to

- Spread financial literacy, especially among the younger generation — helping people make confident choices, invest wisely, and achieve financial freedom.

- Create more Financially Independent families — who can live well, give back, and truly secure their future.